The 9-Second Trick For Eb5 Investment Immigration

Table of ContentsEb5 Investment Immigration Things To Know Before You Get This8 Easy Facts About Eb5 Investment Immigration ShownTop Guidelines Of Eb5 Investment ImmigrationThe Best Guide To Eb5 Investment ImmigrationThe Best Guide To Eb5 Investment Immigration

While we make every effort to provide precise and up-to-date web content, it should not be taken into consideration legal suggestions. Immigration legislations and laws are subject to transform, and individual scenarios can differ widely. For customized guidance and legal recommendations regarding your certain migration scenario, we highly advise seeking advice from with a certified immigration attorney that can provide you with tailored assistance and guarantee compliance with present regulations and laws.

Citizenship, with investment. Currently, as of March 15, 2022, the quantity of investment is $800,000 (in Targeted Employment Areas and Backwoods) and $1,050,000 in other places (non-TEA zones). Congress has actually authorized these amounts for the following five years beginning March 15, 2022.

To certify for the EB-5 Visa, Financiers need to produce 10 full-time united state work within two years from the day of their full investment. EB5 Investment Immigration. This EB-5 Visa Demand ensures that financial investments contribute straight to the U.S. task market. This uses whether the jobs are developed directly by the business business or indirectly under sponsorship of an assigned EB-5 Regional Facility like EB5 United

Getting My Eb5 Investment Immigration To Work

These jobs are figured out with designs that utilize inputs such as development prices (e.g., construction and tools costs) or annual profits created by ongoing procedures. On the other hand, under the standalone, or direct, EB-5 Program, just direct, full-time W-2 worker settings within the commercial business might be counted. A vital risk of counting only on direct workers is that personnel decreases because of market problems can result in insufficient full time placements, potentially bring about USCIS rejection of the financier's application if the task development requirement is not met.

The economic model then predicts the variety of direct tasks the brand-new company is likely to produce based upon its anticipated profits. Indirect work calculated with financial designs describes work generated in sectors that supply the items or solutions to business straight entailed in the job. These tasks are produced as a result of the enhanced demand for items, products, or solutions that support business's operations.

Excitement About Eb5 Investment Immigration

An employment-based fifth preference category (EB-5) investment visa gives an approach of coming to be an irreversible united state resident for international nationals wishing to invest funding in the USA. In order to request this eco-friendly card, a foreign financier has to invest $1.8 million (or $900,000 in a Regional Facility within a "Targeted Work Area") and produce or maintain a minimum of 10 permanent jobs for United States workers (leaving YOURURL.com out the investor and their instant family members).

This measure has actually been an incredible success. Today, 95% of all EB-5 capital is elevated and invested by Regional Centers. Given that the 2008 monetary crisis, access to capital has been constricted and local budgets proceed to face considerable deficiencies. In many areas, EB-5 investments have loaded the funding gap, providing a brand-new, important source of capital for regional financial growth projects that revitalize communities, develop and sustain work, facilities, and services.

8 Simple Techniques For Eb5 Investment Immigration

Even more than 25 nations, consisting of Australia and the United Kingdom, usage comparable programs to draw in foreign investments. The American program is more stringent than lots of others, needing considerable risk for capitalists in terms of both their monetary investment and immigration standing.

Family members and individuals who look for to move to the United States on a long-term basis can apply for the EB-5 Immigrant Financier Program. The United States Citizenship and Migration Provider (U.S.C.I.S.) set out different needs to acquire long-term residency through the EB-5 visa program.: The very first action is to find a qualifying financial investment opportunity.

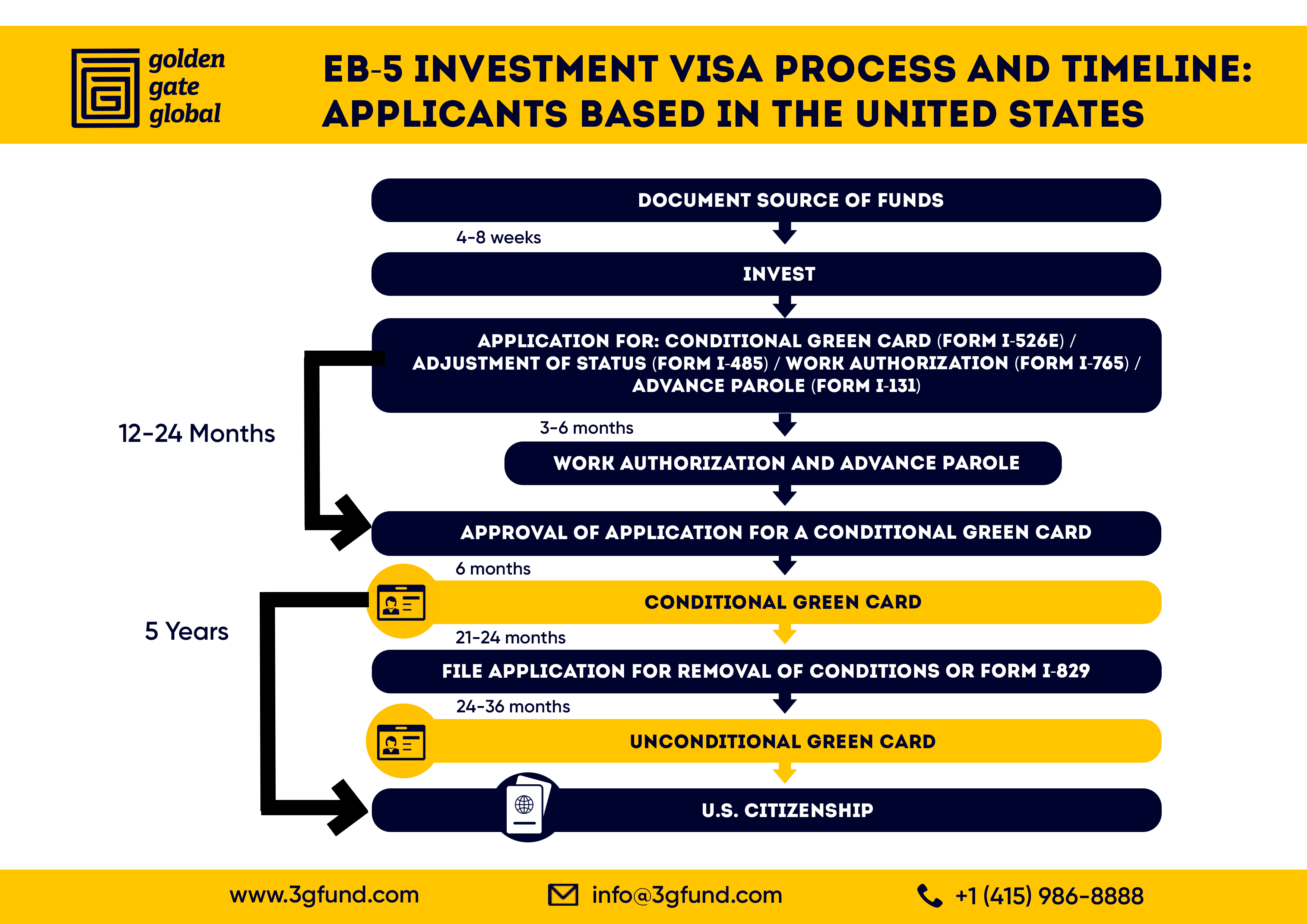

As soon as the opportunity has been identified, the financier needs to make the financial investment and send an I-526 petition to the U.S. Citizenship and Immigration Services (USCIS). This request should include evidence of the financial investment, such as financial institution declarations, acquisition arrangements, and company plans. The USCIS will examine the I-526 application and either approve it or request extra evidence.

Little Known Questions About Eb5 Investment Immigration.

The investor needs to apply for conditional residency by submitting an I-485 application. This request must be sent within six months of the I-526 approval and need to include proof that the financial investment was made and that it has actually produced at the very least 10 permanent work for U.S. workers. The USCIS will certainly examine the I-485 request anonymous and either approve it or request added proof.